Cash Flow Statement:

Example, Format and Components

(Direct Method)

Previous lesson: Balance Sheet Example

Next lesson: Other Accounting Reports

In this tutorial I'm going to go over the format and components of a simple cash flow statement and give you a detailed example (further below).

Be sure to test yourself on how to compile a cash flow statement by trying the Cash Flow Statement Practice Example below as well as the Cash Flow Statement Mini Quiz at the end of the lesson. And right at the bottom of the page, you can find plenty more questions on the topic submitted by fellow students, including a full cash flow statement exercise with detailed solutions.

What is the Cash Flow Statement?

Have you heard of this saying?

Cash is king.

This is a common saying in the business world. And it is quite true, because cash is the lifeblood of the business.

Without cash, you can't pay bills, you can't expand the business by purchasing assets. You can't pay employees. As the business owner, you couldn't even pay yourself!

Just as it sounds, the cash flow statement is a statement (report) of flows of cash - both in and out of the business.

Why Do We Need the Cash Flow Statement?

But why do we need the cash flow statement if we've already got the income statement?

The answer is that one could show the most fantastic performance according to the income statement, with huge profits, and yet have nothing remaining in the bank. Your business wouldn't survive very long in that kind of situation.

You may be wondering, "But how could that even occur?"

It could occur if all or most of your sales have been made on credit. And it could occur if additionally you weren't monitoring the cash flows of your business.

In real life this extreme situation would rarely occur, but this example serves to explain that the cash situation of a business is key. And the cash flow statement, which shows us what the business has been doing with its cash - provides vital information.

So yes, cash really is king - in the business world and even in accounting.

Important: Cash flow statements can be presented using either of two methods: the direct or indirect method. The direct method is used more outside the US, while the indirect method is the preferred method within the US. The format shown below is for the direct method. Please see our separate tutorial on the indirect cash flow statement method for the format and explanations on how to put this together.

Cash Flow Statement Format (Direct Method)

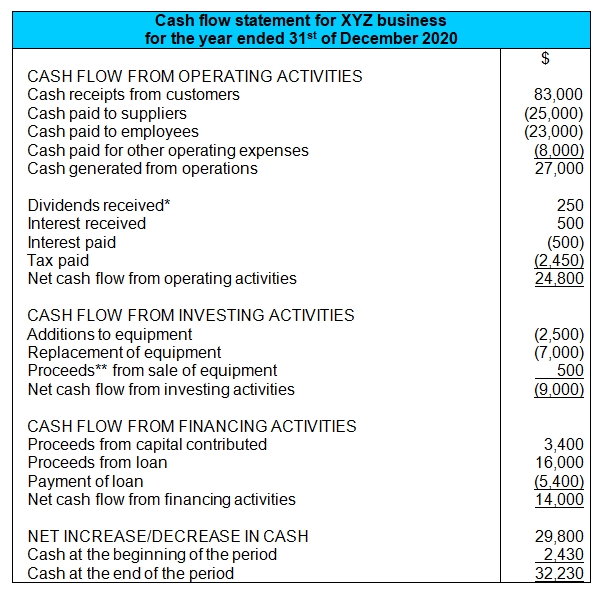

Okay, so before anything else, here's the format of the cash flow statement itself (see further below for explanations):

Notes on the Format Above

- Cash can flow in two directions – either coming in to your business or going out. Cash coming in to your business is shown as positive amounts, whereas cash going out from your business are shown as negative amounts (in parentheses).

- Note that dividends are cash payouts to people who have bought shares in a company. Dividends are similar to drawings (in a small business), in that the owner is getting a payout (drawings is when the owner of a small business withdraws some of the cash that s/he initially invested in the business for personal use).

- Proceeds simply means cash received.

- It's important to note that the cash flow statement covers the flows of cash over a period of time (unlike the balance sheet that provides a snapshot of the business on a specific date).

- Like the rest of the financial statements, the cash flow statement is usually drawn up annually, but can be drawn up more often.

Components of the Cash Flow Statement

The statement is divided into four components. I'll go over each of these below.

1. Cash Flow from Operating Activities

The first component is the cash flows relating to your operations – the core activities of your business.

This includes cash receipts (cash received) from your customers, cash paid to suppliers and employees and for general operating expenses, interest received or paid and tax paid.

2. Cash Flow from Investing Activities

The second component is the cash flow from investing activities.

Investing (in the context of the cash flow statement) means the spending of cash on non-current assets.

For example, one could be spending cash on computer equipment, on vehicles, or even on a building one purchased.

Thus investing activities mainly involves cash outflows for a business.

We also include cash inflows in this section relating to the sale of a non-current asset that we have already invested in. Thus, the cash received this year from selling equipment that was originally bought (invested in) three years ago, would also be included in this section.

As investing activities mainly deal with cash outflows (buying non-current assets), the total of this section is usually a negative.

Purchases of assets are put under two different categories: additions or replacements.

Additions means purchases of additional assets in order to expand the business.

Replacements do not involve expansion but rather refer to an asset being purchased to replace an old or obsolete (no longer used) asset.

3. Cash Flow from Financing Activities

Cash flow from financing activities is the third component.

Financing is the source of the cash that we will be using to invest in non-current assets.

It is where we get cash from.

Thus financing activities mainly involves cash inflows for a business.

Financing can come from the owner (owners equity) or from liabilities (loans).

We also include cash outflows in this section that relate to financing that we originally obtained. Thus the repayment of a loan (in part or in full) falls under financing activities (as a cash outflow), as the loan served as finance for the business originally.

Similarly, drawings (or dividends for a corporation) may also be placed under this section, although it can also be placed under the operating activities section if the business so chooses.

As financing activities mainly deal with cash inflows (receiving cash from shareholders or lenders), the total of this section is usually a positive for cash flow.

4. Net Increase / Decrease in Cash

The final section of the statement comprises the net cash increase or decrease for the period as well as the cash balance at the beginning and end of the period.

Cash Flow Statement Practice Example

(Direct Method)

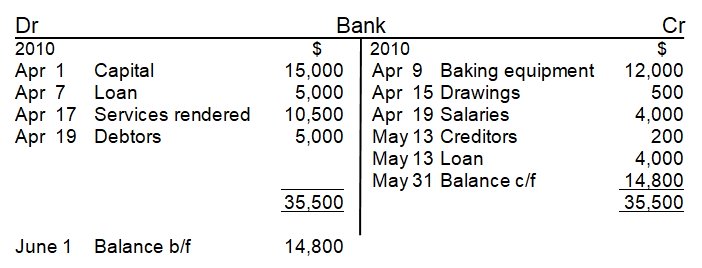

The cash flow statement can be drawn up directly from records of one's cash and bank account.

So one would look over the bank T-account and possibly the cash receipts journal and cash payments journal (if needed).

Here is the bank T-account for the sample business we've been using throughout our tutorials, George's Catering:

Before scrolling down any further, take out a piece of paper and pen and see if you can construct the cash flow statement using only the bank T-account above. When you're finished, return here and check your answers against the solution below.

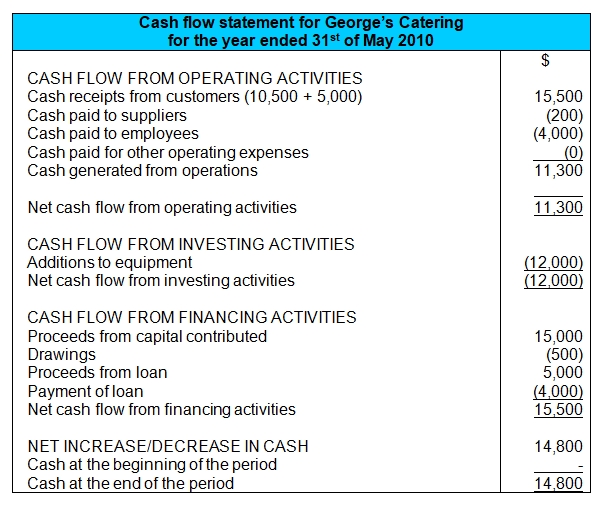

Solution:

The cash flow statement for George’s Catering would look as follows:

Note that the "cash at the beginning of the period" amounted to $0, as this was the first year in which George's Catering was operating. Since most businesses are already up and running for many years, there would usually be an opening cash balance.

Remember, the cash flow statement shows flows of cash, not income and expenses.

Whereas income could be on cash or on credit, cash receipts from customers would only be cash.

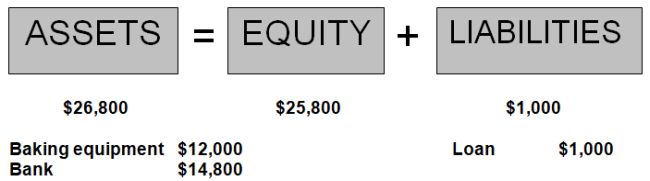

Our accounting equation for George’s Catering looked as follows at the end of the period:

The closing balance of the bank account corresponds to the answer we calculated in our cash flow statement.

Budgeted Cash Flow Statements

Just like the income statement and balance sheet, the cash flow statement can also be drawn up in budget form and later compared to actual figures.

These budgeted figures would be drawn up based on actual figures from past years, but taking into account any expected future changes in cash flows.

The budgeted figures for the cash inflows and outflows (and the way these figures were obtained) would be explained or justified in additional notes to this statement.

By the way, and just as a final note, do not confuse the cash flow statement with a cash budget. These are two completely different things.

Test Yourself!

Before you start, I would recommend to time yourself to make sure that you not only get the questions right but are completing them at the right speed.

Difficulty rating:

Beginner --> Intermediate

Quiz length:

7 questions

Time limit:

8 minutes

Important: The solution sheet on the following page only shows the solutions and not whether you got each of the questions right or wrong. So before you start, get yourself a piece of paper and a pen to write down your answers. Once you're done with the quiz and writing down your answers, click the Check Your Answers button at the bottom and you'll be taken to our page of solutions.

Good luck!

That's all folks! Hope you enjoyed my cash flow statement example and explanations!

Head on over to the next lesson where you'll learn all about other accounting reports you may come across, such as an asset register, a debtor's analysis, and more.

Return from Cash Flow Statement: Example, Format and Components to The Four Types of Financial Statements

Return from Cash Flow Statement: Example, Format and Components to the Home Page

Stay up to date with ABfS!

Follow us on Facebook:

Previous lesson: Balance Sheet Example

Next lesson: Other Accounting Reports

Questions Relating to This Lesson

Click below to see questions and exercises on this same topic from other visitors to this page... (if there is no published solution to the question/exercise, then try and solve it yourself)

Cash Flow Statement Exercise

(Rs. = Rupees = Indian currency)

For the Year Ended 31, Ashad 2068

Amount (Rs. )

Sales revenue 400,000

Cost of goods sold 240,000

Gross profit …

Cash Flow Statement Question:

Negative and Positive Amounts

Question: Cash flow statement shows negative from operating activities but shows positive on cash at the end of the period. Is that possible?

Answer: …

Bad Debts in Cash Flow Statement?

Question: Where is the writing off of bad debts entered on the cash flow statement?

Thanks,

Katrien

Answer: Hi Katrien,

That's kind of …

Cash Flow Statement:

Dividends Paid under Financing or Operating Activities?

Q: Does the payment of dividends go under financing activities or operating activities in the cash flow statement?

A: The answer to this is not …

Cash Flow Statement:

Profit and Retained Earnings

Question: Q: Where do we enter current year profit and retained earnings in the cash flow statement?

Answer: There are two versions or methods or …

Cash Flow Statement:

How to Calculate the Net Increase or Decrease in Cash?

Q: How is the figure for net increase/decrease in cash calculated or arrived at?

A: To calculate the net increase/decrease in cash you simply …

The Indirect Cash Flow Statement Method

Question: What is the complete format of the indirect method of the cash flow statement?

Answer: Before looking at the format of the indirect cash …

Cash Flow Statement:

Purpose and Importance

Q: What is the main purpose of preparing a cash flow statement in an organization? Why is it important?

A: The purpose of the cash flow statement …

Cash Flow Statement and Depreciation

Question: Depreciation charged during the year will come under which activities?

Answer: Depreciation actually does not come under any of the categories …

Cash Flow Statement Exercise with Detailed Solution

Before you begin: It's very important that when you are preparing for tests and exams that you not only answer questions correctly but learn to complete …

© Copyright 2009-2023 Michael Celender. All Rights Reserved.

Click here for Privacy Policy.

Comments

Have your say about what you just read! Leave me a comment in the box below.