Cash Flow Statement:

Profit and Retained Earnings

by Mary Reimoi

(Papua New Guinea)

Question:

Q: Where do we enter current year profit and retained earnings in the cash flow statement?Answer:

There are two versions or methods or ways to present the cash flow statement. Current year profit is part of one version of the cash flow statement and excluded from the other version. And as you'll see below, retained earnings are not part of either version.Cash Flow Statement Direct Method

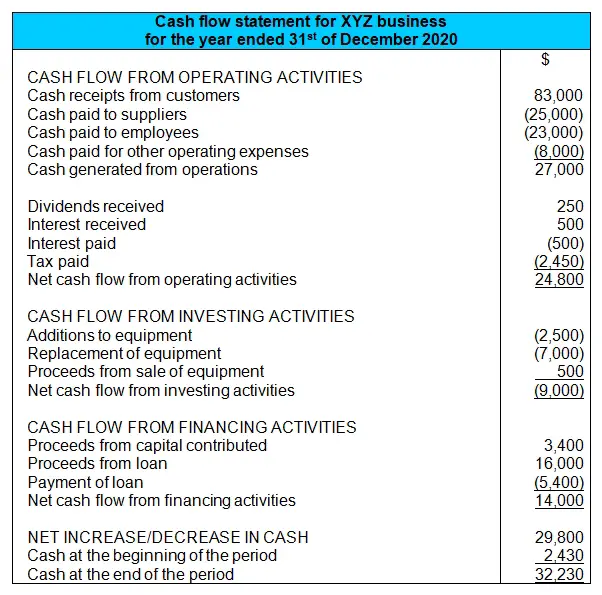

For the cash flow statement prepared using the direct method, shown below, profit is not part of the statement:

Retained earnings is simply accumulated profits. It is the total of profits that have been accumulated over the years for the business. Retained earnings is shown on the balance sheet under the owner's equity section.

Why is profit and retained earnings not included in the direct method of the cash flow statement? Simple. Because both of these profit items do not represent cash.

Remember that profit equals income minus expenses. And both income and expenses can occur with or without a movement of cash. For example, one has the telephone bill as an expense but you don't pay it before the end of the year. This is

The direct method of the cash flow statement only shows cash items. So profits (and retained earnings) are not shown here, only flows of cash coming in and going out.

Cash Flow Statement Indirect Method

Now, as mentioned, profit is included as part of the second version of this statement, the indirect cash flow statement method. In fact, profit is a big part of this:

But still, the profit before tax here is a non-cash item and is just used as a starting point to get to the cash generated from operations figure.

As with the direct method, the indirect method does not include retained earnings.

For more details on how this version of the statement works (including how to do the adjustments to profit before tax), see the full tutorial on the indirect cash flow statement method.

Hope that makes sense!

Best,

Michael Celender

Founder of Accounting Basics for Students

Related Questions & Tutorials:

- The Indirect Cash Flow Statement Method

- Cash Flow Statement and Depreciation

- Bad debts in Cash Flow Statement?

- Cash Flow Statement: Dividends Paid under Financing or Operating Activities?

- Cash Flow Statement Exercise with Full Solution

- Cash Flow Statement: Purpose and Importance

Return to the main Cash Flow Statement Tutorial

Return to Ask a Question About This Lesson!.

© Copyright 2009-2021 Michael Celender. All Rights Reserved.

Click here for Privacy Policy.