What is Inventory?

Lesson One: What is Inventory? (current page)

Lesson Two: FIFO Method and Weighted Average Cost

Lesson Three: Sales, Cost of Goods Sold and Gross Profit

Lesson Four: Perpetual and Periodic Inventory

Lesson Five: Accounting for Manufacturing Businesses

Lesson Six: The Manufacturing Cost Statement

What is inventory?

In this lesson we're going to define inventory in accounting, explain what it means for different businesses, compare service, trading and manufacturing businesses to one another and see how items of inventory fit into these businesses.

Be sure to check your understanding of this lesson by taking the quiz in the Test Yourself! section further below. And right at the bottom of the page, more questions on the topic submitted by fellow students.

Inventory Definition in Accounting

Inventory are stock, goods, merchandise.

It's those assets, those products, those things of value, that you either buy from another or make yourself, that you then sell on to someone else (at a higher price than what it cost you to buy or make the inventory).

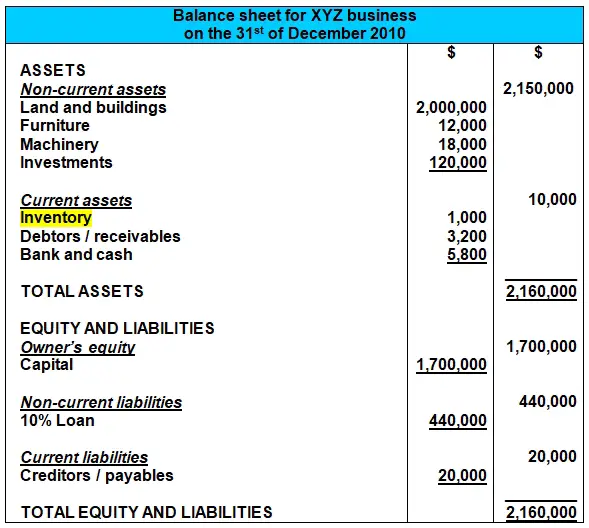

As you can see above, inventory are classified as current assets in accounting.

This is because the business intends to sell them (and usually does) within a year from the date that it is listed on the balance sheet.

Explaining Inventory - Examples

Here are some examples to help explain what kind of goods could classify as inventory for different businesses:

1) Joe Superathlete Shoes sells Adidas and Nike shoes.

Guess what? Those are both inventory for his business because they are bought from the manufacturers of the shoes and are sold to the public at a higher amount, resulting in a profit for the business.

2) Morgan Used Cars sells used cars. Are these inventory?

Well, motor vehicles would fall under non-current assets in the balance sheet for most businesses. However, in this particular case, the business intends to sell them as part of their regular business operations (and in less than a year), and so these cars are classified as "inventory" under the category of "current assets."

3) Davison Investments is a property investment company, trading in residential and commercial properties. Now, these properties - land and buildings - couldn't possibly be anything but a non-current (long-term) asset, could they? Actually, they could.

Just like motor vehicles, land and buildings often fall under "non-current assets" in the balance sheet for a business. However, because Davison Investments trades in properties - meaning they intend to sell them as a regular part of their business operations (i.e. within a year), then these properties are classified as "inventory" for their business (and just as before, under "current assets").

So as you can see, inventory are not necessarily small items that are sold quickly.

The size of the asset, or how quickly one can sell it, is not the overriding factor when classifying an asset as inventory.

The overriding factor is what the business intends to do with the asset.

If they bought it (or made it) with the intention of selling it for a higher price, and they routinely sell this type of asset to others, then that asset is inventory.

Service vs Trading vs Manufacturing Businesses

Now, in our lessons and examples up until now we've been looking at transactions, debit and credit journal entries, T-accounts and reports for service businesses.

Service businesses are businesses that provide a service, such as accounting services, tailoring services, electrical services, banking and medical.

But there are two other types of businesses apart from service businesses, both of which revolve around the selling of inventory.

Those two other types of businesses are trading and manufacturing businesses.

In the lessons throughout our website chapter on inventory we'll look at the different accounting rules for inventory and how these are applied in trading and manufacturing businesses.

But first, let's make sure we fully understand what trading and manufacturing businesses are and what they have to do with inventory.

Trading businesses (like the one shown above) are businesses that buy inventory at a low price and sell it to someone else at a higher price.

Examples of trading businesses are clothing stores, hardware stores, supermarkets as well as online traders.

Retail stores are always trading businesses as they buy inventory at a low price from a wholesaler or manufacturer and sell these at a higher price to consumers.

Unlike trading businesses, manufacturing businesses do not buy products at a low price and then just sell these at a higher price. Instead manufacturing businesses make products, which they then sell.

This does not mean that manufacturing businesses never purchase anything. Manufacturing businesses routinely purchase raw materials such as wood, chemicals, metals, etc., that they use to manufacture a product. But their core operations are about manufacturing new products, not just buying and selling them with no additional input (which is essentially what a trading business does).

Some common examples of manufacturing businesses are vehicle manufacturers and even bakeries (bakeries could be said to manufacture cakes, cookies, bread, etc.).

One Final Type of Business

By the way, there may be one other category of business apart from service, trading and manufacturing businesses... A business that also deals with inventory... Care to take a guess?

This category consists of businesses who extract or gather natural resources and sell these. Businesses like mining companies and farmers.

These guys don't manufacture (make) corn or gold or wool. They also don't buy it at a low price and sell it at a higher price.

They extract it or grow it in nature themselves.

I don't know what you'd call this business category exactly, but they're definitely a category on their own, and they definitely have inventory too.

Test Yourself!

Before you start, I would recommend to time yourself to make sure that you not only get the questions right but are completing them at the right speed.

Difficulty Rating:

Beginner --> Intermediate

Quiz length:

7 questions

Time limit:

8 minutes

Important: The solution sheet on the following page only shows the solutions and not whether you got each of the questions right or wrong. So before you start, get yourself a piece of paper and a pen to write down your answers. Once you're done with the quiz and writing down your answers, click the Check Your Answers button at the bottom and you'll be taken to our page of solutions.

Good luck!

Okay, so that's it for our lesson on What is Inventory?

I hope you enjoyed it and now have a better understanding of what could be classified as inventory.

In the next lesson we'll go over common ways to value inventory in our records.

So if you're ready, click ahead to the lesson on FIFO and LIFO Accounting and the Weighted Average Method.

Return from What is Inventory? to the Home Page

Stay up to date with ABfS!

Follow us on Facebook:

Lesson One: What is Inventory? (current page)

Lesson Two: FIFO Method and Weighted Average Cost

Lesson Three: Sales, Cost of Goods Sold and Gross Profit

Lesson Four: Perpetual and Periodic Inventory

Lesson Five: Accounting for Manufacturing Businesses

Lesson Six: The Manufacturing Cost Statement

Questions Relating to This Lesson

Click below to see questions and exercises on this same topic from other visitors to this page... (if there is no published solution to the question/exercise, then try and solve it yourself)

Scrap Gold And Inventory?

Q: I have a company that buys gold from people (jewelry, coins, etc). They then send this gold to a company out of state who in turn sends them a check …

Four Ways for Valuing Inventory

Q: I have a question on my study guide for my final on Monday. It says "What are the 4 ways for valuing inventory?" I cannot find a definite answer to …

Work-In-Progress Inventory &

Stage Of Completion Valuation

Q: I want to ask how do you calculate opening work in progress inventory and closing work in progress inventory... and whether this calculation should …

What are Merchandise Inventory?

Q: What are merchandise inventory? What does this consist of?

A: Merchandise are finished goods that can be sold to the consumer. This includes anything …

What is the Accounting Entry for Giving Away a Free Sample?

Q: What entry will be passed in the general journal for goods taken as a free sample?

A: The first thing to work out here is whether free samples …

© Copyright 2009-2023 Michael Celender. All Rights Reserved.

Click here for Privacy Policy.

Comments

Have your say about what you just read! Leave me a comment in the box below.