Cash Flow Statement Question:

Negative and Positive Amounts

Question:

Cash flow statement shows negative from operating activities but shows positive on cash at the end of the period. Is that possible?Answer:

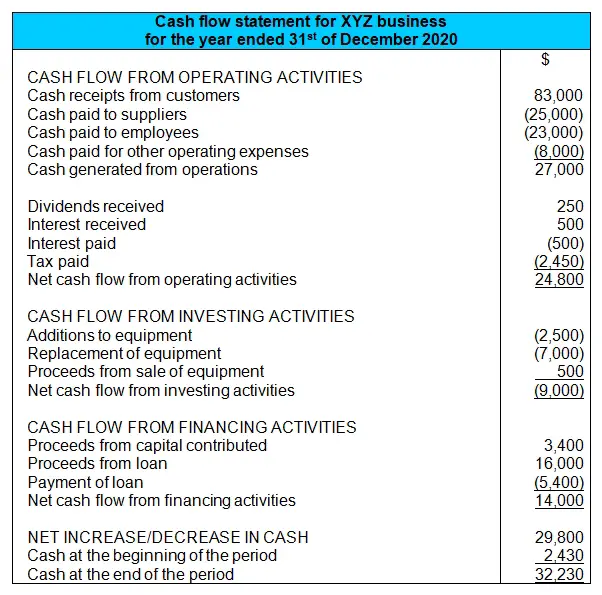

Yes, this is definitely possible.Remember that there are three parts of the cash flow statement:

- Cash flow from operating activities

- Cash flow from investing activities

- Cash flow from financing activities

Cash flow from operating activities is usually positive and this would indicate that the business is successful in terms of the overall cash flow related to its operations (sales, services provided, etc.).

Cash flow from operating activities is usually positive and this would indicate that the business is successful in terms of the overall cash flow related to its operations (sales, services provided, etc.).Cash flow from investing activities is usually negative. This is because the business in investing its cash, meaning it is spending on non-current assets, for example buying new machinery and equipment. But it can also include selling non-current assets for cash (i.e. positive cash flow).

Cash flow from financing activities is usually positive. Financing basically means sourcing cash from somewhere - or the action of getting cash for the business. When a business receives cash it is positive for cash flow. But this category also includes paying back sources of cash, such as repaying a loan or repaying an investor.

Cash flow from financing activities is usually positive. Financing basically means sourcing cash from somewhere - or the action of getting cash for the business. When a business receives cash it is positive for cash flow. But this category also includes paying back sources of cash, such as repaying a loan or repaying an investor. A key point is that each of these three categories can be negative or positive for

In our question here where cash flow is negative for operating activities but overall is positive, it means the positive cash flow in the rest of the statement (from investing and financing activities) was greater than the negative cash flow from operating activities.

What may have happened here is the business either sold non-current assets for a lot of cash or, even more likely, it received a lot of cash from financing (cash from a loan or from an investor). Or both of these.

What may have happened here is the business either sold non-current assets for a lot of cash or, even more likely, it received a lot of cash from financing (cash from a loan or from an investor). Or both of these.Hope that makes sense!

Best,

Michael Celender

Founder of Accounting Basics for Students

Related Questions & Tutorials:

- Cash Flow Statement: How to Calculate the Net Increase or Decrease in Cash?

- Cash Flow Statement: Dividends Paid under Financing or Operating Activities?

- The Indirect Cash Flow Statement Method

- Cash Flow Statement Exercise with Full Solution

Return to the main Cash Flow Statement Tutorial

Comments for Cash Flow Statement Question:

|

||

|

||

|

||

© Copyright 2009-2021 Michael Celender. All Rights Reserved.

Click here for Privacy Policy.