The Indirect Cash Flow Statement Method

by Haider

(Lahore)

Question:

What is the complete format of the indirect method of the cash flow statement?Answer:

Before looking at the format of the indirect cash flow statement, let's go over what this is and why you need to know it.Direct vs Indirect Cash Flow Statement

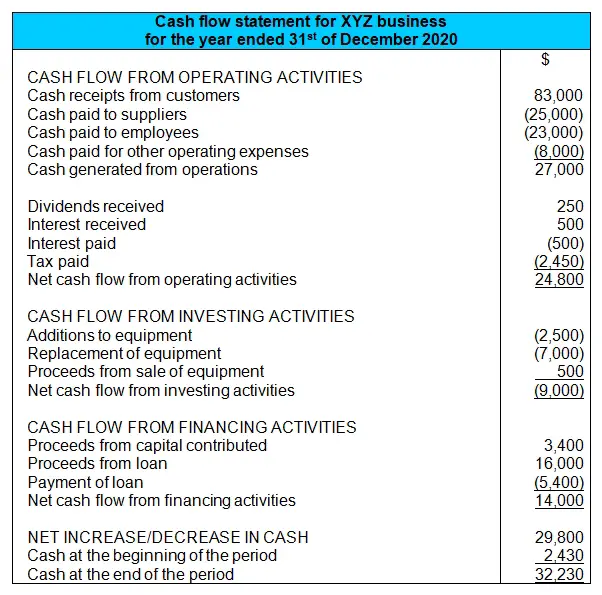

With a regular cash flow statement prepared using the direct method, we take the following amounts from our accounting records and input them directly in the first section of the statement:- Cash receipts from customers

- Cash paid to suppliers

- Cash paid to employees

- Cash paid for other operating expenses

Note that according to International Accounting Standard (IAS) 7, Statement of Cash Flows: "Entities are encouraged to report cash flows from operating activities using the direct method. The direct method provides information which may be useful in estimating future cash flows and which is not available under the indirect method."

US GAAP allows businesses to choose the direct or indirect method, but even when using the direct method, a reconciliation of cash flow from operating activities to net profit (net income) is required. Many US corporations use the indirect method, so this method should be known.

Note that in the US the indirect method does not start with profit before tax but rather with net income, which is basically another word for net profit (after tax).

Indirect Cash Flow Statement Format

Here is the format for the indirect cash flow statement (starting with profit before tax):

The format after cash generated from operations is the exact same as that for the indirect method - dividends, interest paid, tax paid, cash flow from investing activities, cash flow from financing activities and onward. The only section that has changed is the cash flow from operating activities.

Adjustments

If the "adjustments" and the "working capital changes" shown above look complicated to you, you're not alone. I'll do my best to explain these below.Let's take a closer look at the section that has changed, the cash flow from operating activities:

Adjustments for Non-Cash Items

The income statement includes income and expense items that do not involve any movement of cash. The most common of these non-cash items are depreciation and bad debts.

The income statement includes income and expense items that do not involve any movement of cash. The most common of these non-cash items are depreciation and bad debts.Depreciation is the planned reduction of the value of fixed assets. There is no movement of cash. Just the value of equipment or vehicles or similar assets reducing, and that annual decrease in value is as an expense known as depreciation.

Bad debts are simply debts that were owed to you that now seem unlikely to be paid. This expense also does not involve cash.

Bad debts are simply debts that were owed to you that now seem unlikely to be paid. This expense also does not involve cash.These non-cash items are included as expenses to calculate the net profit, but in the cash flow statement we are calculating a

Since depreciation and bad debts are expenses that would have been minused from our incomes in the income statement to arrive at the profit, to reverse them, we add them back.

Income Statement Items not Part of Cash Generated from Operations

Another thing to adjust are any cash income and expense items from the income statement which are included in later sections of the cash flow statement (underneath the cash generated from operations).

Another thing to adjust are any cash income and expense items from the income statement which are included in later sections of the cash flow statement (underneath the cash generated from operations).Common items that would fall into this category are dividends received, interest received, interest paid and any profits on the sale of fixed assets (this falls under investing activities). Each of these items must now be reversed.

To reverse these items, you simply do the opposite of what they were in the income statement. So for example, for interest received (income), this was included as a positive in the income statement, so to reverse it we now have to minus it.

Changes to Working Capital

This is probably the most difficult of all the adjustments.

This is probably the most difficult of all the adjustments.Working capital are short-term assets and liabilities, namely your inventory, debtors (accounts receivable) and creditors (accounts payable).

Debtors are your customers, while creditors are your suppliers (and sometimes your employees too).

Debtors are your customers, while creditors are your suppliers (and sometimes your employees too).Remember, the income statement, which is prepared on the accrual basis, includes both cash and credit sales to your customers (debtors), as well as both cash and credit purchases from your suppliers (creditors). The net profit includes all sales and all purchases, so now we want to remove the credit portion of these. To do so, we must input the changes to debtors, creditors and inventories during the year.

This is how I work out whether the change in debtors, creditors and inventory must be a positive or negative figure in our adjustment:

- Debtors: If debtors have decreased during the year, it means overall our customers have paid down more of their debts (rather than creating more debts). So this is a cash inflow for our business and should be a positive amount. Likewise, if debtors have increased during the year, it should be a negative figure as we have made more credit sales that we have not been paid for.

- Creditors: If creditors have decreased during the year, it means we have paid down more of our debts to suppliers rather than incurring new debts. So this is a cash outflow (negative figure). Likewise, if our creditors have increased, it is the opposite. It is like a cash inflow as we have received more inventory and services without paying for it.

- Inventory: If our inventories have increased during the year, we generally must have paid more money for this, so we have a cash outflow (negative figure). But if our inventories decreased during the year, it's the opposite - we bought less, so we have a positive cash flow figure.

That's it for the indirect cash flow statement method!

What did you think of this tutorial and this method? Do you still have any questions?

Have your say by adding a comment below.

Best,

Michael Celender

Founder of Accounting Basics for Students

Related Questions & Tutorials:

- Cash Flow Statement: Profit and Retained Earnings

- Cash Flow Statement and Depreciation

- Cash Flow Statement: Purpose and Importance

- Cash Flow Statement Exercise with Full Solution (Direct Method)

Click here to return to the main Cash Flow Statement Tutorial

Return to Ask a Question About This Lesson!.

© Copyright 2009-2021 Michael Celender. All Rights Reserved.

Click here for Privacy Policy.