Cash Flow Statement Exercise with Detailed Solution

by Niranjan

(Jodhpur, India)

Before you begin: It's very important that when you are preparing for tests and exams that you not only answer questions correctly but learn to complete the questions at the right speed. Please time yourself while attempting this exercise.

Difficulty Rating:

Intermediate --> Advanced

Time limit:

35 minutes

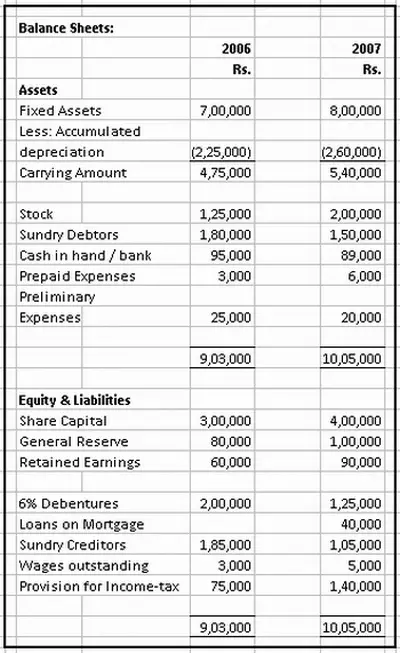

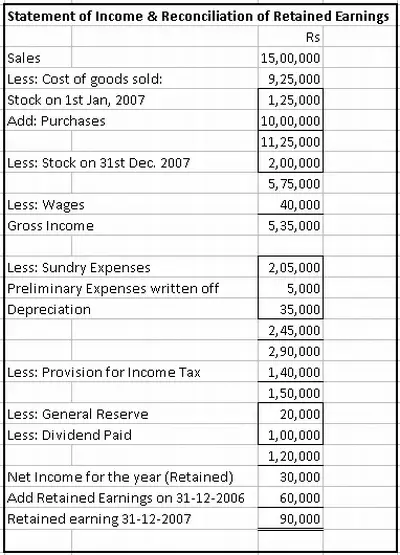

Please note that in this question Rs = Rupees = Indian currency. Also figures are written in Indian style: Rs 1,00,000 (Indian figure) = 100,000 Rupees (Western system). Rs 15,30,000 (Indian figure) = 1,530,000 Rupees (Western system). Etc., etc.

Question:

SVKM’s Narsee Monjee Institute of Management Studies (NMIMS)School of Distance Learning

SUBJECT : ACCOUNTING AND FINANCE

FOR MANAGERS Marks: 20

All questions are compulsory:

Good Luck Limited has submitted the following condensed Balance Sheets as on 31st December, 2006 and 31st December, 2007 and the Statement of Income and Reconciliation of Retained Earnings for the year ended 31st December, 2007:

Additional Information:

1. The cash inflow and outflow during the course of operations of the firm are as follows:

Collection from customers Rs 15,30,000

Cash paid to suppliers Rs 10,80,000

Cash paid to employees and other expense Rs 2,46,000

Income tax paid during the year Rs 75,000

2. During 2007, the company purchased a building for Rs 1,00,000.

You are required to prepare the Cash Flow Statement and comment on the cash flow condition of the company.

*****************************************************

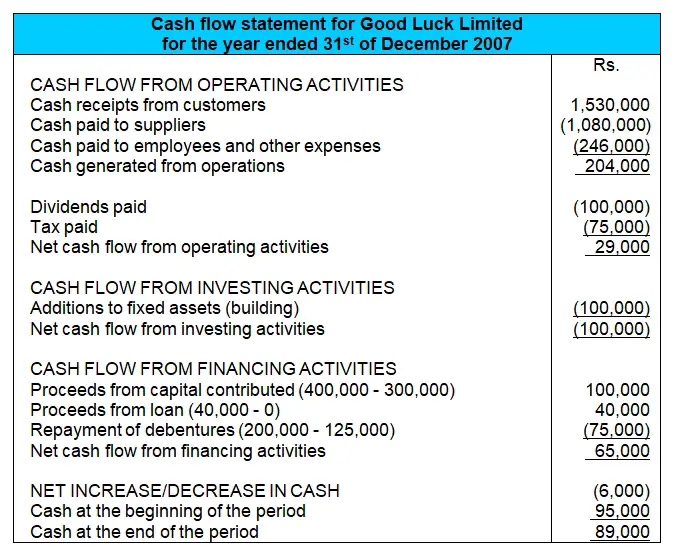

Solution:

Notes to the Above Solution:

Here are a few important points about this solution and general pointers about how to go about answering a typical cash flow statement question.Since you are graded or marked according to each correct line item you put in the cash flow statement, the most important thing is to try get as many correct line items in there - even if you don't get everything done or your final "net increase or decrease in cash" doesn't add up correctly - get as much in there as possible so you get maximum marks.

With that in mind, one of the first things I complete is the final lines of the cash flow statement with the cash at the beginning and the end of the period, which they either just tell you (as they did in this question) or they show you under the balance sheet line item "cash and cash equivalents."

You can then also do a quick calculation of the net increase or decrease in cash.

The next thing I would do is fill in any of the other items that they give you. In this case, they gave you cash receipts from customers (1,530,000), cash paid to suppliers (1,080,000) and cash paid to employees and other expenses (246,000).

They also gave tax paid (75,000) and the investment in the building (100,000), which is an "addition."

One of the other easy things they gave is the dividends paid figure (100,000), which is listed in the income statement (or the "statement of income and reconciliation of retained earnings" as they gave here).

Remember that depreciation is an expense only in the accounting books, not an actual cash expense, so

Some of the Trickier Points:

The share capital increased by 100,000 during the year, which means 100,000 cash inflow. This is calculated as the difference between the closing balance and opening balance (400,000 - 300,000).Note that we don't include any changes in the general reserve in the above calculation of capital contributed as they show in the income statement that this amount (20,000) was taken from the profit figure. So it is not a cash investment, only an amount in the books. The same applies to the retained earnings - no actual cash movement here, just a distribution of our profits to equity accounts.

When we look at the non-current or long-term liabilities we can see that the debentures decreased by 75,000, which means we paid this amount to the holders of that debt. We can also see that the mortgage loan increased from 0 to 40,000, which means a cash inflow equal to 40,000.

The creditors and wages outstanding are already taken into account to calculate the "cash paid to suppliers and employees" figure that was given to us.

Final Notes - Interest and Prepaid Expenses

As a final note, there are a few unusual points in this question which don't seem to require anything in the solution but may require more attention in another cash flow statement question:1) Good Luck Limited has interest-bearing long-term debt in the form of the debentures and the mortgage loan. Interest paid is a pretty routine line item in the cash flow statement (under "cash flow from operating activities"). However, since they did not give an interest payment amount and since we don't know exactly when the debentures and mortgage amounts changed during the year, we cannot calculate the interest paid here.

2) The preliminary expenses (an asset account) is reduced as 5,000 is written off as an expense during the year. This was not a cash movement but rather just recognizing part of this asset's balance as an expense in the books.

However, the prepaid expenses account increases by 3,000 during the year. This would indicate a cash outflow of 3,000 and should be included somewhere in the cash flow statement. However, if you try include this as a line item in the cash flow statement, it throws off the final calculated net cash flow figure. The only explanation is that this 3,000 is already included in the figure for "cash paid to suppliers" which they gave us (1,080,000).

So, how did you find this cash flow statement exercise?

Was it similar to the ones you've seen in your classes?

Did you get most of the points right?

Have your say by adding a comment below.

Best,

Michael Celender

Founder of Accounting Basics for Students

Related Questions & Tutorials:

- The Indirect Cash Flow Statement Method

- Cash Flow Statement and Depreciation

- Bad debts in Cash Flow Statement?

- Cash Flow Statement: Current Year Profit & Retained Earnings

- Cash Flow Statement: Dividends Paid under Financing or Operating Activities?

- Cash Flow Statement: Purpose and Importance

Return to the main Cash Flow Statement Tutorial

Click here for more Full Accounting Exercises

Comments for Cash Flow Statement Exercise with Detailed Solution

|

||

|

||

|

||

|

||

© Copyright 2009-2021 Michael Celender. All Rights Reserved.

Click here for Privacy Policy.