The Basic Accounting Journal Entries

Previous lesson: Source Documents

Next lesson: Accounting Journals: The Books of First Entry

In this lesson we're going to learn exactly what a journal is and what it looks like, and we'll go over the basic accounting journal entries you need to know.

Check your understanding of this lesson by taking the quiz in the Test Yourself! section further below. And right at the bottom of the page, you can find more questions on the topic submitted by fellow students.

So What Exactly is a Journal?

Journals (or journal entries) are simply records of individual transactions in chronological (date) order.

They are chronological accounting records, each one composed of a debit and a credit.

What is the Purpose of Journal Entries?

The purpose of journal entries is to keep a day-to-day, chronological record of a business and its transactions.

What Do Journals Look Like?

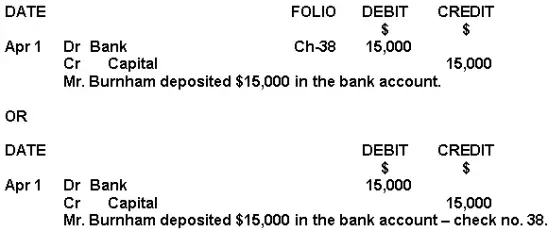

Journal entries look like this:

If you're not yet familiar with journal entries, don't worry! Check out the section just below for a summary of the most common journals, including links to each of the individual lessons...

Does this look at all familiar? It should – we have been doing these basic accounting journal entries throughout the previous section on double-entry accounting.

The Ten Most Common Journal Entries

There are roughly ten common transactions that occur repeatedly in accounting, each of which has a different journal entry.

Below is a brief summary of these transactions and journals. For each of these transactions below I've included a quick description of the transaction, the journal entry, as well as a link to the detailed lesson on this site that teaches that specific journal entry in-depth.

1. Journal Entry for the Owner Investing Capital

This is where the owner invests assets in a business. This results in owner's equity and is more specifically known as capital or a capital investment:

Click here for the full Equity Example Lesson.

2. Journal Entry for a Liability (Debt)

A liability is simply a debt. In this transaction a business receives some asset and owes someone else for this. In this particular example the business receives a loan.

Click here for the full Liability Example Lesson.

3. Journal Entry for Purchasing an Asset

In this transaction the business spends money in order to obtain an asset. Since money itself is an asset, you're essentially swapping one asset for another.

Click here for the full Asset Example Lesson.

4. Journal Entry for Withdrawing Owner's Funds

When an owner of a business withdraws funds from the business for personal use, this is known as drawings. This is simply the opposite of capital.

Click here for the full lesson on Recording Drawings.

5. Journal Entry for Cash Income

When a business earns income and receives the payment for this immediately, we record the following:

Click here for the full lesson on Recording Income Received in Cash.

6. Journal Entry for Income on Credit

This is the journal entry for when a business makes income but does not receive the payment for this straight away. Accounts receivable is recorded (this is also known as receivables or debtors). This is an asset account representing the amount of funds owed to us.

Click here for the full lesson on the Journal for Income on Credit.

7. Journal Entry for Receiving Money from a Debtor

When a debtor (receivable) pays us, we record the following:

Click here for the full lesson on Recording a Payment from a Debtor.

8. Journal Entry for Expenses Paid in Cash

When we have an expense and pay this immediately, we record the following:

Click here for the full lesson on Cash Expenses.

9. Journal Entry for Accounts Payable

In this transaction we have an expense but we don't pay it straight away. The expense is owing. A liability is thus created. When we owe our suppliers, we call them accounts payable (or creditors). Accounts payable represent the value of these debts that we owe.

Click here for the full lesson on Accounts Payable.

10. Journal Entry for Paying Our Creditors

Here we actually pay our creditors the money that we owe them.

Click here for the full lesson on Paying Off Creditors.

The Origin of Journals

The journal is actually the book of first entry.

It used to be an actual book that the bookkeeper would use to make accounting entries.

Of course, these days bookkeepers enter transactions in an accounting program on the computer. So these books of first entry are now just in digital form.

Examples of journals include the Cash Receipts Journal (CRJ) and the Cash Payments Journal (CPJ).

A recording in one of the journals is called a journal entry.

Some Final Technical Points...

Each transaction and journal entry not only require a debit and credit but are also often accompanied by a brief explanation of the transaction. This is written just below the debit and credit.

This explanation should accurately describe what took place, so that anyone who glanced at it for the first time could easily identify what occurred.

Journals also sometimes include a cross-referencing code or folio number, which matches the journal to some other document from another stage of the accounting cycle.

For example, a journal can be matched to the relevant source document (such as a check stub or a receipt).

With the first transaction above of $15,000 capital, the folio includes the code 'Ch-38,' referring to check number 38, which was the particular check written by the owner when making this payment.

Using the folio number to match a journal entry to a source document would enable a person to easily trace the recorded transaction back to the source document and verify the transaction and its amount.

So this code or folio number simply cross-references between one document and another.

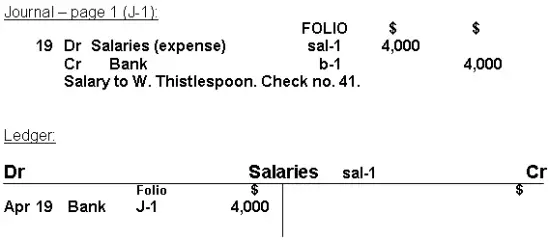

Journals can also include a code or folio number to cross-reference between the journal entries and the T-accounts (the next step in the accounting cycle).

These cross-referencing numbers or codes would work like this:

‘Sal-1’ is the individual code for the Salaries account. ‘J-1’ is the code for journal page 1.

Each specific item, such as Salaries, would have its own folio number or code, and this would be used to cross-reference from the journal entry involving Salaries to the T-account for Salaries in the ledger (the ledger and T-accounts will be covered in a future lesson).

One could thus follow information from the journal entry to an account in the ledger, or vice versa.

The folio numbers make it simple to trace information through the various steps in the accounting cycle.

Test Yourself!

Before you start, I would recommend to time yourself to make sure that you not only get the questions right but are completing them at the right speed.

Difficulty rating:

Beginner

Quiz length:

4 questions

Time limit:

5 minutes

Important: The solution sheet on the following page only shows the solutions and not whether you got each of the questions right or wrong. So before you start, get yourself a piece of paper and a pen to write down your answers. Once you're done with the quiz and writing down your answers, click the Check Your Answers button at the bottom and you'll be taken to our page of solutions.

Good luck!

That's it!

Basically everything you need to know about the basic accounting journal entries!

Actually, not quite everything yet...

Remember how I said earlier that the journal is the book of first entry?

Well, there's actually seven different "books" - seven different journals.

And in our next lesson we're going to look at each of these journals (books), what they're used for, and how they work.

So what are you waiting for? Click through to the next lesson on the accounting journals.

Return from Basic Accounting Journal Entries to The Accounting Cycle

Return from Basic Accounting Journal Entries to the Home Page

Stay up to date with ABfS!

Follow us on Facebook:

Previous lesson: Source Documents

Next lesson: Accounting Journals: The Books of First Entry

Questions Relating to This Lesson

Click below to see questions and exercises on this same topic from other visitors to this page... (if there is no published solution to the question/exercise, then try and solve it yourself)

Journal Entry Question:

Purchase with Personal Funds

Q: On 25th March 2011 Mr. A purchased goods to the value of rs. 25000 (rs = Rupees = Indian, Pakistani and Sri Lankan currency). Due to a shortage of …

Journal Entry Example: Complex Capital Investment by Owner

(Compound Entry)

Q: What is the journal entry for the following transaction:

Mr. A starts his business by bringing $1000 cash, accounts receivable $500, furniture …

Journal Entries and Ledger

Question and Answer

Before you begin: For purposes of testing and exams it's important to make sure you not only answer questions and exercises correctly but also complete …

What is the Journal Entry for Bad Debts?

Q: What is the journal entry for bad debts?

A: First of all, let's define bad debts.

Bad debts are debts to your business that have gone "bad," …

Journal Entry for Shares Issued

Question: Make a journal entry for the following (assume that this occurred in the second half of 2009):

a) Issued additional shares for 1,200 in …

Accounting Journals:

Gift, Sale, Discount & Carriage Paid By Another

Q: What are the journal entries for the following:

1) Received gift of Rs 51,000 from father-in-law by check, which is deposited into business bank …

Journal Entries Accrual Items Question

Q: I want to know how do you make the following journal entries (rs = Rupees = Indian currency):

1. Outstanding expense - rs 3,000

2. Accrued interest …

Basic Journal Entries Question

Before you begin: It's important for testing and exams to make sure you not only answer questions correctly but also complete them at the right speed. …

Basic Accounting Journal Entries Exercise

Before you begin: For purposes of testing and exams it's important to make sure you not only answer exercises correctly but do so at the right speed. …

What are the Journal Entries for a Returned Check?

Q: Dear Sir,

Can you please explain what the journal entry will be when a check we issued is returned by the bank? And when they reproduce it?

…

Journal Entry Question and Answer

Before you begin: It's important for testing and exams to make sure you not only answer questions correctly but also complete them at the right speed. …

Recording Retained Earnings

in the Journal

Q: How do you record retained earnings in the journal?

A: Earnings means profits and retained earnings is all the net profits one accumulated. …

© Copyright 2009-2023 Michael Celender. All Rights Reserved.

Click here for Privacy Policy.

Comments

Have your say about what you just read! Leave me a comment in the box below.