Supplies Expense Example: Accounting Equation & Journal Entry

Q: How do you account for "estimated expenses" in the accounting equation?

Q: How do you account for "estimated expenses" in the accounting equation?

For example: Estimated supplies used for 6 months R700.

(R = Rands = South African currency)

How will this transaction affect the accounting equation?

A: Regardless of the accounting equation or anything else, estimated expenses is unusual. All expenses should be tracked and calculated accurately without any need to "estimate" them.

However, the situation might arise where a certain expense was not closely tracked and so a reasonable estimate would serve as the next best thing.

An estimated expense, supplies expense or any other, is still an expense. So the question is really "how do you account for the supplies expense in the accounting equation?"

The answer is simple:

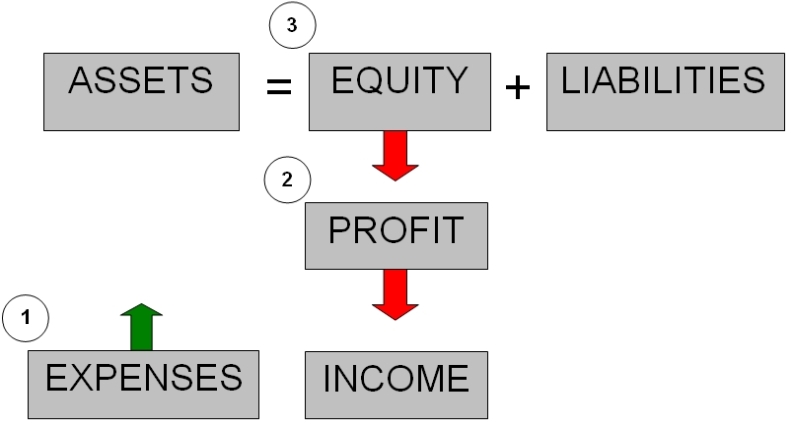

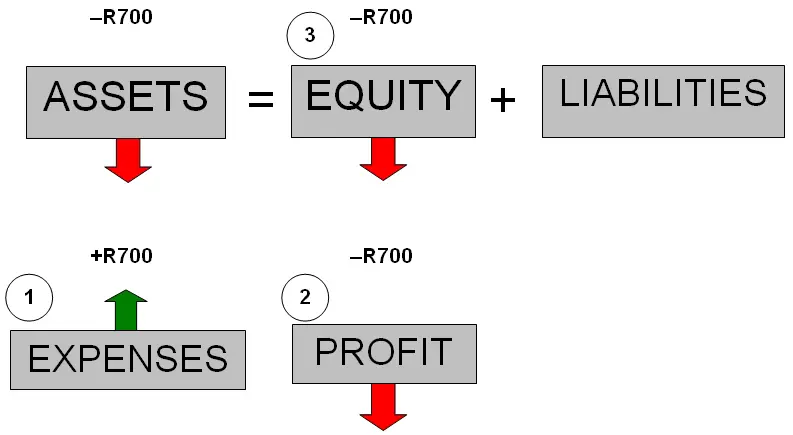

Expenses (1) are the opposite of income. Expenses reduced profit (2), which means less for the owner, so less share of the assets for the owner - less owner's equity (3).

Additionally, those supplies that were used are assets. So when they are used, the assets would decrease:

In case you were wondering, the journal entry for the above would be:

DR Supplies Used (expense)...............R700

CR Supplies (asset).........................................R700

Since "Supplies Used" is an expense, and expenses always occurs on the left side, this account is debited.

"Supplies" is an asset account which is decreasing. Assets increase on the left side (debit) and decrease on the right (credit), so supplies is credited.

FYI, another term commonly used for supplies that one consumes or uses in ones business is "consumables."

Does that supplies expense example for the accounting equation make sense? Let me know by clicking "Click here to post comments" further below.

And check out the related tutorials and questions just below.

Best,

Michael Celender

Founder of Accounting Basics for Students

Related Questions & Tutorials:

- Full Tutorial: The Basic Accounting Equation or Formula

- Accounting Equation Questions and Answers

- Accounting Equation Exercise: Fill in the Blank

Return to the main tutorial on The Accounting Equation and Expenses

Return to Ask a Question About This Lesson!.

© Copyright 2009-2021 Michael Celender. All Rights Reserved.

Click here for Privacy Policy.