Posting Journal Entries to the Ledger

(T-Accounts)

Previous lesson: Balancing T-Accounts

Next lesson: Debtors and Creditors Control Accounts

Posting journal entries may sound fairly complicated, but it's actually simpler than you might think. In this lesson we'll learn exactly what this entails and go through an example to illustrate how it's done.

Be sure to check your understanding of this lesson and how to post journals to the T-accounts by taking the quiz in the Test Yourself! section further below. And right at the bottom of the page, you can find more questions on the topic submitted by fellow students.

What Does Posting Journal Entries Mean?

As previously mentioned, the first step in the accounting cycle is the collection of the source document, and the second step is recording the journal entries.

The third step in the accounting cycle is the posting of these journal entries to the ledger (T-accounts).

But what does posting exactly mean?

Very simple. Posting means to transfer the information calculated in the journals to the various T-accounts in the ledger.

Note: If you landed directly on this page but are struggling with accounting journals or T-accounts themselves, then check out the following tutorials first and then return to this lesson:

- The Basic Accounting Journal Entries (definition, purpose, format, and the 10 most common journal entries in accounting)

- Accounting Journals: The Books of First Entry (CRJ, CPJ, SJ, SRJ, PJ, PRJ, GJ)

- T-Accounts and Ledgers (including an exercise where you can practice drawing up a basic T-account)

Posting Journal Entries Example

Let's see exactly how this transfer of information from the journals to the T-accounts is done.

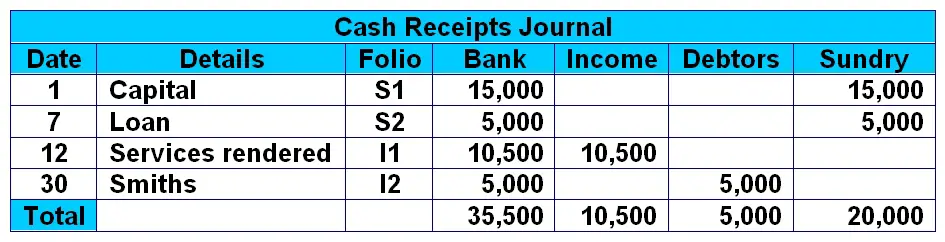

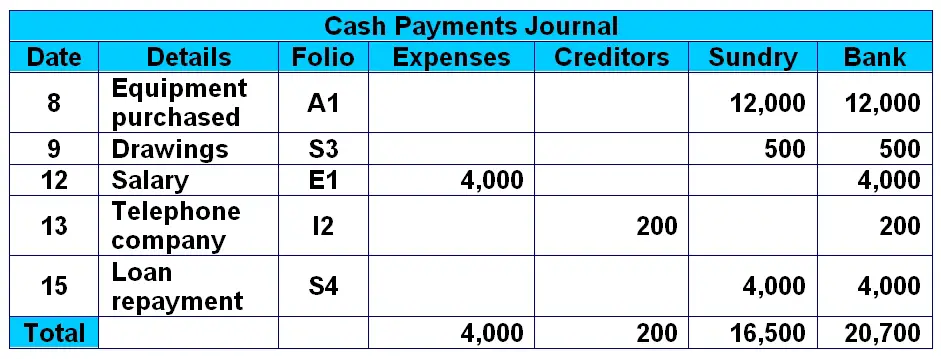

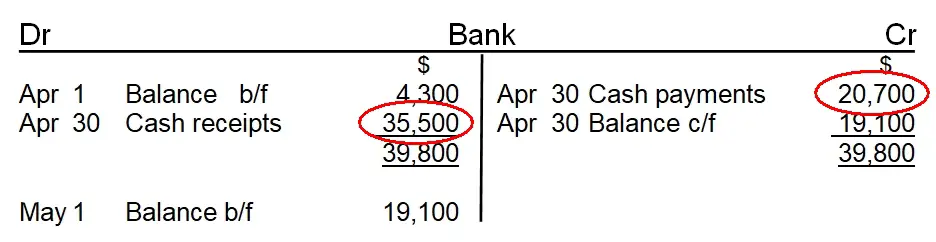

Take a look at the cash receipts and cash payments journals below, followed by the "Bank" T-account, then read on for the explanation of what information was posted (transferred) to this T-account and why:

First of all, a reminder about T-Accounts:

The T-account is a summary record of everything for a specific accounting item that occurred during a certain period of time.

The T-account shows the opening and closing balances as well as the individual transactions during the period covered.

In the "Bank" T-Account above you should be able to see that there is an opening and closing balance, as well as two line items for the total of "Cash receipts" and "Cash payments."

These last 2 totals come directly from the two journals above:

The $35,500 cash receipts in the "Bank" T-account comes from the total of the "Bank" column in the cash receipts journal.

And the $20,700 cash payments in the "Bank" T-account come directly from the total of the "Bank" column in the cash payments journal.

As you can see, we don't put each individual transaction from the journals concerning bank into the "Bank" T-account, but rather just the totals.

We take the total of cash receipts from the cash receipts journal (column "bank") and insert this on the debit side of the "bank" T-account. And we take the total of cash payments from the cash payments journal (column "bank") and insert this on the credit side of the "bank" T-account.

This is the act of posting journal entries to the ledger.

As you can see, we get to the same closing balance as in the previous lesson where we learned how to balance T-accounts.

Note that modern accounting programs handle the posting of journal entries to the ledger automatically. However, it's still good to know how posting works, especially if there's any errors that need to be corrected and/or traced back through the system.

Test Yourself!

Before you start, I would recommend to time yourself to make sure that you not only get the questions right but are completing them at the right speed.

Difficulty rating:

Beginner

Quiz length:

3 questions

Time limit:

3 minutes

Important: The solution sheet on the following page only shows the solutions and not whether you got each of the questions right or wrong. So before you start, get yourself a piece of paper and a pen to write down your answers. Once you're done with the quiz and writing down your answers, click the Check Your Answers button at the bottom and you'll be taken to our page of solutions.

Good luck!

Return from Posting Journal Entries to the Ledger to The Accounting Cycle

Return to the Home Page

Stay up to date with ABfS!

Follow us on Facebook:

Previous lesson: Balancing T-Accounts

Next lesson: Debtors and Creditors Control Accounts

Questions Relating to This Lesson

Click below to see questions and exercises on this same topic from other visitors to this page... (if there is no published solution to the question/exercise, then try and solve it yourself)

Creditors Allowances Question

Q: Where does the creditors allowances go?

A: Let's first clarify what this means. Creditors allowances is basically all instances where creditors …

© Copyright 2009-2023 Michael Celender. All Rights Reserved.

Click here for Privacy Policy.

Comments

Have your say about what you just read! Leave me a comment in the box below.