Loan Repayment Journal Entry

Previous lesson: Accounts Payable Journal Entries

Next lesson: The Accounting Cycle

In this lesson we're going to cover a typical transaction of paying back a long-term liability and see what a loan repayment journal entry looks like.

Be sure to check your understanding of this lesson and the loan repayment journal entry by taking the quiz in the Test Yourself! section further below. And right at the bottom of the page, you can find more questions on the topic submitted by fellow students.

How is a Bank Loan Classified in Accounting?

Remember, when dealing with a bank loan we're talking about a liability account, meaning a debt account.

Since a bank loan is typically taken out for a long period of time, it is usually classified as a non-current liability. This means that we expect to hold the loan for a period of at least one year.

Bank Loan Payable Journal Entry Example

Before this loan repayment, our sample business, George's Catering, stood as follows:

- $30,800 assets (consisting of $12,000 baking equipment and $18,800 bank)

- $25,800 equity

- $5,000 liabilities (bank loan payable)

k) George sees that he has quite a bit of spare cash, and so decides to pay back some of the loan from the bank. He writes out a check for $4,000. What happens to our equation?

As usual, the first and easiest thing we can always look at is whether anything happens with our cash or bank. And in this case, we're making a payment, so our bank account decreases.

The next thing to ask is what are we making the payment for? The answer is the loan, the liability. The amount of the loan will decrease when we make the payment.

So, both our bank and liability are going to decrease:

The loan is not completely paid off here, it is reduced to $1,000. In other words, we are showing that we still owe $1,000.

Before we look at the journal entry for repaying a loan, let's review the original journal entry from our earlier lesson where we took out the loan in the first place:

Bank increased, as we were receiving money. Since it's an asset, it had to be debited.

The loan was also increasing. Since it's a liability account, it had to be credited.

Now the journal entry for repaying the loan is as follows:

This is the exact opposite of the first journal entry above.

Bank (or cash) is an asset. Assets increase on the debit side (left side) and decrease on the credit side (right side).

A loan is a liability. It increases (or occurs) on the credit side and decreases on the debit side.

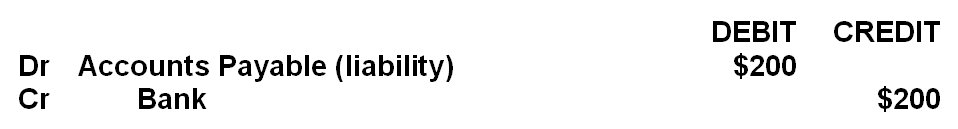

By the way, the journal entry for repaying the loan is actually very similar to the journal entry for paying off a creditor in our previous lesson on accounts payable:

As you can see in this journal entry, we credited the bank account, just like in the journal entry to repay the loan. That credit means that the bank is decreasing.

The debit entry here is simply to a different type of liability account: accounts payable (creditors). It shows that the amount we owe our creditors is decreasing.

Once again, in summary, you can see that:

For every transaction there are two entries.

For every transaction there is a debit.

For every transaction there is a credit.

There are no exceptions.

And it bears repeating:

The debits and credits are based wholly on the accounting equation:

Test Yourself!

Before you start, I would recommend to time yourself to make sure that you not only get the questions right but are completing them at the right speed.

Difficulty Rating:

Beginner

Quiz length:

3 questions

Time limit:

4 minutes

Important: The solution sheet on the following page only shows the solutions and not whether you got each of the questions right or wrong. So before you start, get yourself a piece of paper and a pen to write down your answers. Once you're done with the quiz and writing down your answers, click the Check Your Answers button at the bottom and you'll be taken to our page of solutions.

Good luck!

Journal entries are actually pretty simple now, right?

If you've come this far and really get what we did up to now, then I'm proud to announce that you have slain the debit and credit monster! You know enough about debits and credits to debit or credit virtually anything in the entire subject (well almost)! And that's a lot more than most accounting students!

If, however, you're still concerned with this monster called debits and credits at this point, then please check out our mind-blowing lesson called Debits and Credits: What They Really Mean, which should make debit and credit journal entries much, much easier and help you slay this monster once and for all.

In the next chapter we're going to take a step back and look at the big picture in accounting, the Accounting Cycle - the series of actions a bookkeeper or accountant takes to record, categorize and present the financial information of a business.

Well done for getting this far! You are doing very, very well. Keep going!

Return to Double Entry Accounting

Return to the Home Page

Stay up to date with ABfS!

Follow us on Facebook:

Previous lesson: Accounts Payable Journal Entries

Next lesson: The Accounting Cycle

Questions Relating to This Lesson

Click below to see questions and exercises on this same topic from other visitors to this page... (if there is no published solution to the question/exercise, then try and solve it yourself)

Interest Charged by a Creditor on an Overdue Account

Interest charged by a creditor on an overdue account would be debit or credit?

A: To answer this question you first have to work out what interest …

© Copyright 2009-2023 Michael Celender. All Rights Reserved.

Click here for Privacy Policy.

Comments

Have your say about what you just read! Leave me a comment in the box below.