Journal Entry for Drawings

Previous lesson: Journal Entry for Asset Purchase

Next lesson: Journal Entry for Income (Cash Example)

In this lesson we're going to go through our earlier drawings example using our sample business, George's Catering, and use it to work out the full journal entry for drawings.

Be sure to check your understanding of this journal entry and lesson by taking the quiz in the Test Yourself! section further below. And right at the bottom of the page, you can find more questions on the topic submitted by fellow students.

To skip the drawings example and explanations below and go straight to the journal entry we record for drawings, click here.

Before we dive into this lesson and our example, a quick reminder of some terms:

Capital vs Drawings

Just as the owner can invest assets in the business from his personal possessions – so too can he remove assets from the business for personal use.

Remember that the investment of assets in a business by the owner is called capital.

When the owner removes assets from his business, we call this by another name. We call this drawings.

This is because the owner withdraws assets.

Drawings are the exact opposite of capital.

In the US drawings are sometimes referred to as the owner's drawing, owner's draw or just draw.

Drawings Example

Okay, so let's look at our original drawings example:

d) George Burnham is running short of cash at home. He needs some money to buy his daughter a bicycle for her birthday (i.e. for personal use). He decides to withdraw $500 from the business bank account.

As usual, we're first going to look at how this transaction affects the basic accounting equation and which accounts are affected, and only then will we work out the double entry.

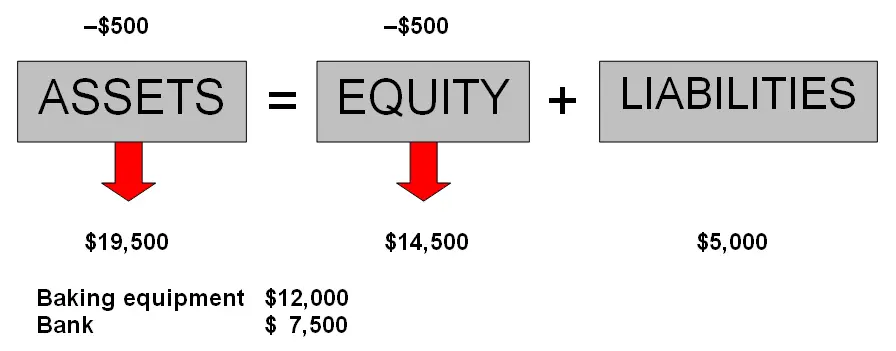

This is how the transaction would affect the accounting equation:

So, what has happened here?

First of all, bank has decreased by $500.

Remember, assets increase on the debit side (left) and decrease on the credit side (right).

So when an asset account decreases, that account is credited.

The owner‘s stake in the assets (owner's equity) has also decreased.

The owner’s equity increases on the credit side (right). And it decreases on the debit side (left).

So what do we do with the owner’s equity? We debit it.

Journal Entry for Drawings

So the journal entry for drawings is:

Please note that the owner's equity account we use in the above entry is "drawings."

Theoretically we could have debited the "capital" account, which would show that it is decreasing.

However, we don't ever debit the "capital" account when assets are withdrawn from the business by the owner. We always debit the "drawings" account.

We keep the capital account as one account for investments in the business by the owner, and drawings as a separate account to show only divestments or withdrawals by the owner.

The double entry above is actually the exact opposite of our earlier owner's equity journal entry (capital), where Mr. Burnham put assets into the business, except that we are now using "drawings" instead of "capital."

In summary, it should be quite apparent again that:

For every transaction there are two entries.

For every transaction there is a debit.

For every transaction there is a credit.

There are no exceptions.

It should also be quite apparent that the debits and credits are based wholly on the above accounting equation.

Test Yourself!

Before you start, I would recommend to time yourself to make sure that you not only get the questions right but are completing them at the right speed.

Difficulty Rating:

Beginner

Quiz length:

4 questions

Time limit:

5 minutes

Important: The solution sheet on the following page only shows the solutions and not whether you got each of the questions right or wrong. So before you start, get yourself a piece of paper and a pen to write down your answers. Once you're done with the quiz and writing down your answers, click the Check Your Answers button at the bottom and you'll be taken to our page of solutions.

Good luck!

If you feel good about the drawings example above, then go ahead and move on to the next lesson where you'll learn the journal entry for income received in cash.

Return from Journal Entry for Drawings to Double Entry Accounting

Return from Journal Entry for Drawings to the Home Page

Stay up to date with ABfS!

Follow us on Facebook:

Previous lesson: Journal Entry for Asset Purchase

Next lesson: Journal Entry for Income (Cash Example)

Questions Relating to This Lesson

Click below to see questions and exercises on this same topic from other visitors to this page... (if there is no published solution to the question/exercise, then try and solve it yourself)

Journal Entry Question

(Complex Owner Drawings)

How do I do the double entry for this?

Alex withdrew $100 cash and took goods costing $100 (selling price was $150) for personal use.

Drawings Journal Entry Question

Question: What is the journal entry for this transaction?

Owner withdrew office equipment from business $800. Solution: This is a typical question …

Drawings Example: Non-Cash Assets

(Office Supplies)

Q: If an owner withdraws $200 of office supplies for personal use is this a decrease in office supplies AND a decrease in owner's equity?

A: Yes …

Using owner's money to pay business utility bills

Q: If the owner pays some phone and electricity bills for home RM215 and office RM323 by using her saving money, what would the double entry be?

Is …

© Copyright 2009-2023 Michael Celender. All Rights Reserved.

Click here for Privacy Policy.

Comments

Have your say about what you just read! Leave me a comment in the box below.