Credit Sale Journal Entry Example

by Pontso Tsiane

(Johannesburg)

Q: What is the journal entry for the following?

Q: What is the journal entry for the following?

Sold goods to R. Botha on credit of R242,39. Issued invoice 001.

(R = Rands, South African currency)

A: The above is a typical example of a sale on credit.

Even though this is a relatively straightforward transaction, a sale on credit, there are actually two possibilities for the journal entries we record. The exact double entry will differ depending on whether the business in question is using the periodic or perpetual inventory system.

1) Periodic Inventory System

The periodic inventory system is where our records of goods are only periodically accurate (i.e. only at certain points in time, namely when we do a physical inventory account). Because we don't have perpetually (continuously) accurate records of our inventory, we use the Purchases account, an expense account, when we purchase goods - instead of an asset account (Inventory).Here is the journal entry for a credit sale under the periodic inventory system:

Dr Debtors / Accounts Receivable.................R242.39

Cr Sales......................................................................R242.39

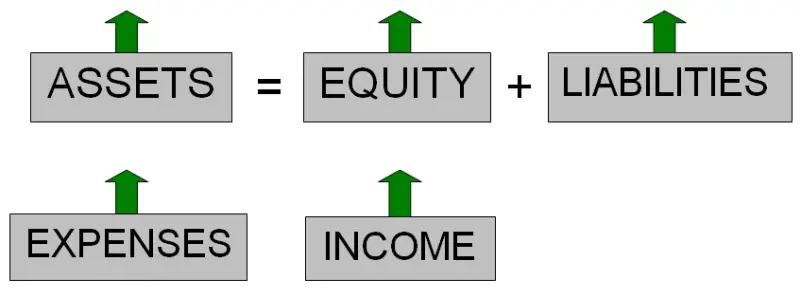

Sales are income, which occurs on the right side of our accounting equation, so we credit it. The debit entry (left side entry) is to our asset account, Debtors or Accounts Receivable, which is increasing. Debtors or accounts receivable is the total of amounts owed to our business.

Note that we do not do anything with Cost of Goods Sold at this point in time, we only calculate and record Cost of Goods Sold at the end of the accounting period.

2) Perpetual Inventory System

With the perpetual inventory system we do keep perpetual (continuously up-to-date) records of our inventory on hand. As a result, when we purchase goods, we record an asset account called Inventory (instead of the Purchases account used in the periodic system).Here is the journal entry for a credit sale under the perpetual inventory system:

Dr Debtors / Accounts Receivable.................R242.39

Cr Sales......................................................................R242.39

This is the exact same as for the periodic system. However, in the perpetual

Dr Cost of Goods Sold.................R150

Cr Inventory.........................................R150

(For the entry above, I'm assuming these goods we sold for R242.39 originally cost us R150)

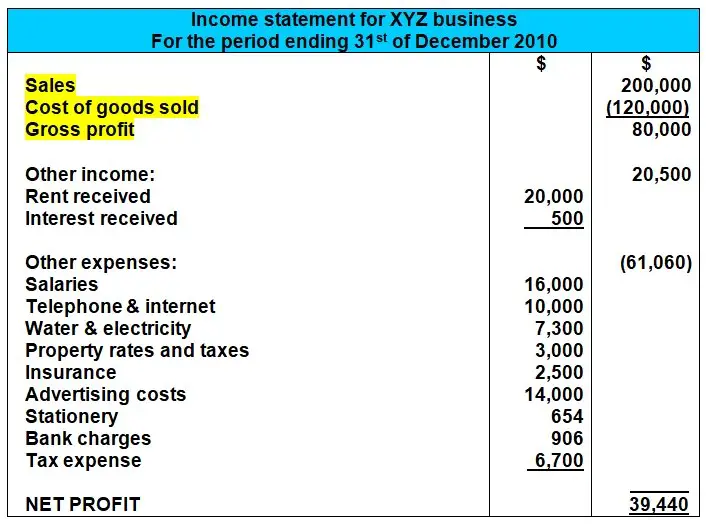

In this second journal entry for the perpetual system, we remove the inventory (asset account) from our records by crediting it at its original cost price and we debit the Cost of Goods Sold account, which is an expense account which will be used to compare against Sales in our income statement to work out the Gross Profit:

Remember, this second journal entry above at the time of the credit sales transaction (Inventory and Cost of Goods Sold) is only for the perpetual inventory system, it does not apply to the periodic inventory system. Under the periodic inventory system we'll do a similar entry for Cost of Goods Sold but only at the end of the period, after a full physical inventory count to verify the actual goods on hand.

So, as you can see, one has to know which kind of inventory system is being used before one can do the correct journal entries at the time of the credit sale.

In most accounting questions they will tell you if the business is using a periodic or perpetual system. If they don't mention either one explicitly (like this question), you can usually assume that they are using a periodic system.

What did you think of this credit sale journal entry example? Have your say by clicking "Click here to post comments" below.

And if you found these concepts or journals confusing, take a look at some of the related tutorials (listed below), especially the full tutorial on Perpetual and Periodic Inventory.

All the best with your accounting studies and journal entries!

Best,

Michael Celender

Founder of Accounting Basics for Students

Related Questions & Tutorials:

Return to the full tutorial on Perpetual and Periodic Inventory

Click here for more Basic Accounting Questions and Answers

Return to Ask a Question About This Lesson!.

© Copyright 2009-2021 Michael Celender. All Rights Reserved.

Click here for Privacy Policy.