Unearned Revenue

Q: Is unearned revenue a current liability?

A: In short, yes, it is a current liability. A full explanation follows...

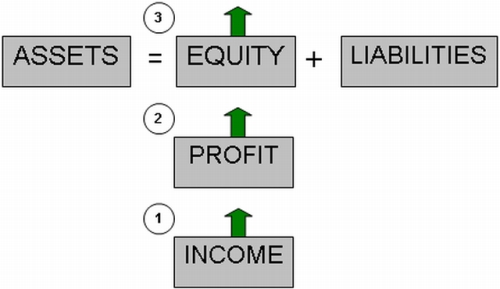

You see, revenue or income is on the right side of the accounting equation, as it results in more profit and more for the owner (owners equity increases).

Unearned revenue is when you get paid for services or products BEFORE you've actually delivered the service or products. Other names for this are Prepaid Income or Income Received in Advance. You are being pre-paid or paid too early.

Unearned revenue is when you get paid for services or products BEFORE you've actually delivered the service or products. Other names for this are Prepaid Income or Income Received in Advance. You are being pre-paid or paid too early. In accounting we consider this prepayment like a debt. You don't owe money, you owe the services or products you agreed to deliver.

The journal entry for this would be:

Dr Cash

Cr Unearned Revenue

The Unearned Revenue or Income Received in Advance is also on the right side but it is not regarded as income, it is regarded as a liability (a debt).

In this situation one usually expects to deliver the service or product within a period of the year from being paid, therefore one counts it as a current liability.

FYI there are full lessons on prepayments in the basic accounting books I wrote, as well as a bunch of lessons on other topics that are not covered on this site.

Return to Ask a Question About This Lesson!.

© Copyright 2009-2021 Michael Celender. All Rights Reserved.

Click here for Privacy Policy.