Balance Sheet, Owner's Equity Statement and Income Statement: Temporary vs Permanent Accounts

by Kei

(Charleston, South Carolina)

Q: The three primary financial statements that we have seen so far are the Balance Sheet, Statement of Owner’s Equity, and the Income Statement. Please describe which account categories belong on which statement and identify them as temporary or permanent.

Temporary vs Permanent Accounts

First of all, let me clarify the difference between "temporary" and "permanent" accounts.Temporary accounts are accounts that start with a balance of zero at the beginning of each year and are used to calculate other figures at the end of the year (namely, the profit or loss for the year).

When these end-of-year calculations are done, the account is cancelled out or started again from zero. Thus "temporary."

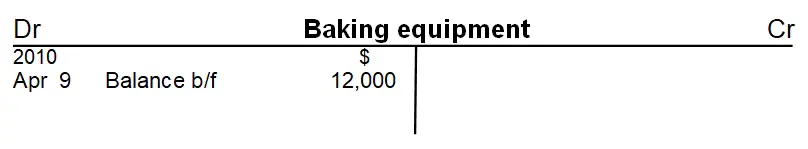

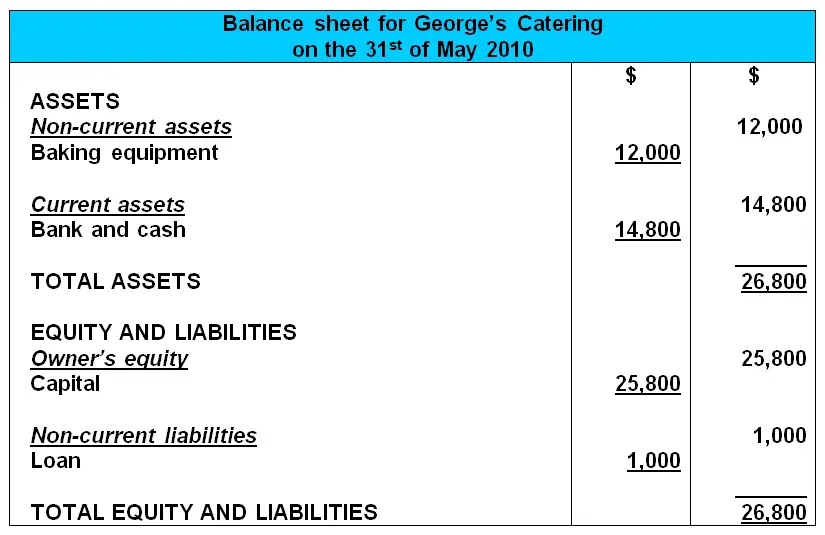

Permanent accounts, on the other hand, start with a balance of zero only when the business has just begun. Thereafter, year after year after year, they continue with their balance and are never cancelled out or reduced back to zero. Their balance is carried through from the end of one year to the beginning of the next.

Now let's look at the different statements and the types of accounts (temporary or permanent) that are shown in each one...

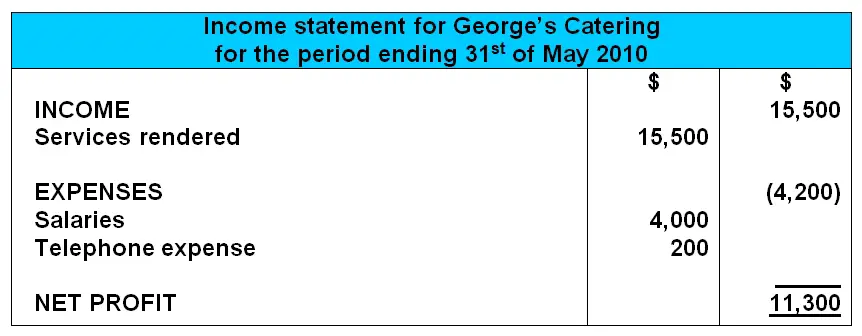

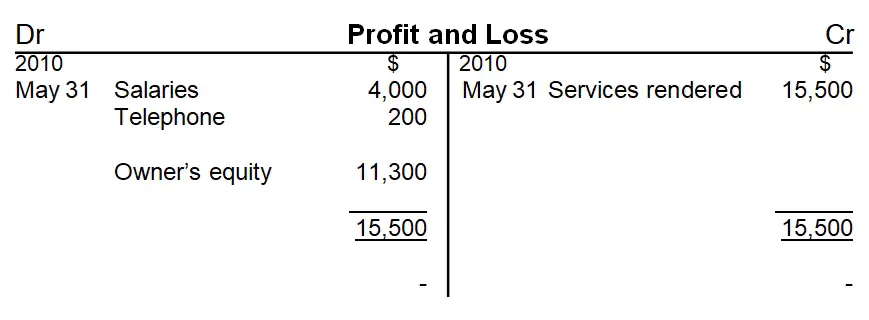

The Income Statement

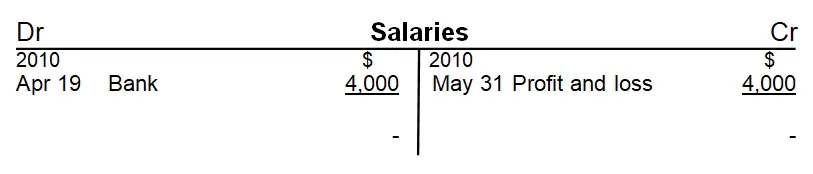

The balances of incomes and expenses are cancelled out at the end of each year and started again from zero at the beginning of each year. That is why they are known as "temporary" accounts.

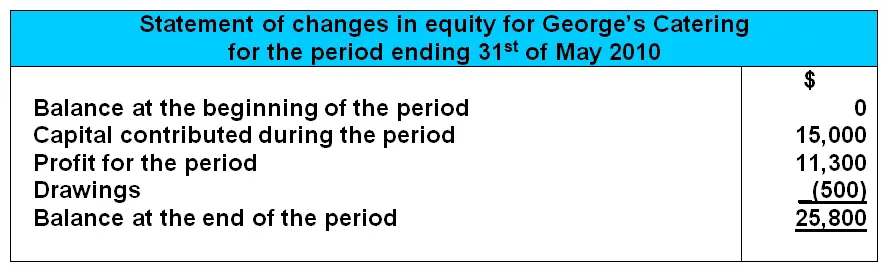

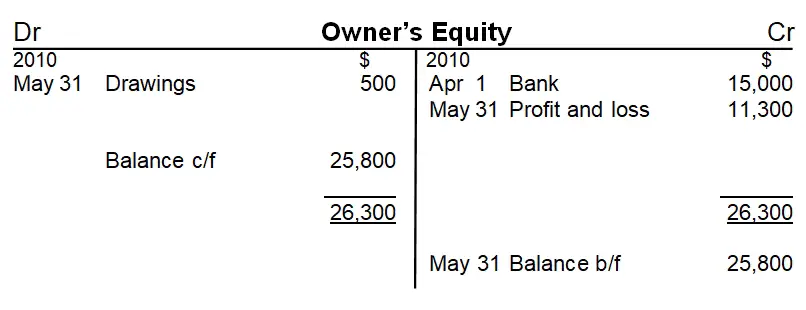

The Statement of Changes in Equity

The profit and loss account is temporary as it starts from zero each year. Profit belongs to the owner/s and is used to calculate the new balance of the owner's equity account at the end of each year.

Owner's equity (sometimes called "Capital") is a permanent account as its balance is carried on from one year to the next.

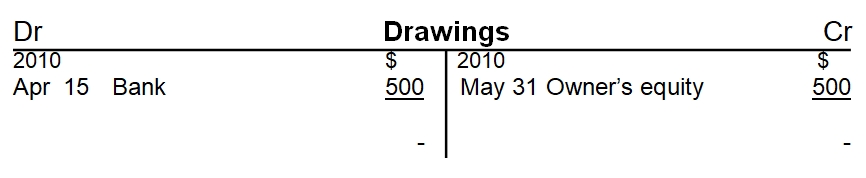

Drawings (or "dividends" for a company) is a temporary account as its balance starts from zero and is calculated newly each year. Just like the profit account, drawings is used to calculate the new balance of the owner's equity account at the end of each year.

The Balance Sheet

(or Statement of Financial Position)

The subject of cancelling out temporary accounts (known as "closing entries") is only covered in my basic accounting books (not available for free on this website). You are welcome to check them out if you need more info on closing entries.

Hope that makes sense!

Best,

Michael Celender

Founder of Accounting Basics for Students

Related Questions & Tutorials:

- Accrued Expenses and Revenue: Closed or Not?

- Basic Accounting Quiz: Capital Expenditure vs Revenue in Nature

- Basic Accounting Quiz: Asset and Liability Balance Sheet Categories

- Order of Financial Statements

Return to our full tutorial on Financial Statements

Comments for Balance Sheet, Owner's Equity Statement and Income Statement: Temporary vs Permanent Accounts

|

||

|

||

|

||

|

||

© Copyright 2009-2021 Michael Celender. All Rights Reserved.

Click here for Privacy Policy.