Cash Flow Statement:

Dividends Paid under Financing or Operating Activities?

by Shamil Hassan

(Islamabad, Pakistan)

Q: Does the payment of dividends go under financing activities or operating activities in the cash flow statement?

Q: Does the payment of dividends go under financing activities or operating activities in the cash flow statement?

A: The answer to this is not so straightforward.

According to the definitive international statement on this, International Accounting Standards (IAS) 7, Statement of Cash Flows:

"Dividends paid may be classified as a financing cash flow because they are a cost of obtaining financial resources. Alternatively, dividends paid may be classified as a component of cash flows from operating activities in order to assist users to determine the ability of an entity to pay dividends out of operating cash flows."

However, according to US GAAP (Generally Accepted Accounting Principles) Accounting Standards Codification Topic 230, dividends paid must be classified under financing activities.

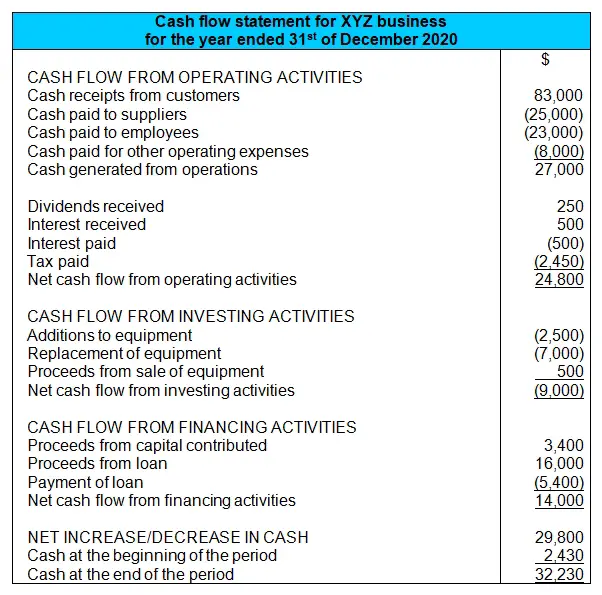

But that's the rule for the US. From what I was taught (which was outside the US), the usual practice is to put it under cash flow from operating activities. The reason for this is that it could be considered to be a regular part of one's operations or operating activities - one usually pays dividends once a year to one's investors (the business owners) as standard company practice.

Since repayments of loans to the business also go under this section (cash flow from financing activities), it seems logical to include dividends paid to investors in this section too. Both investments and loans are sources of finance, so paying them should also go under this section.

So bottom line: If you're outside the US, dividends paid can go under either operating activities or financing activities. If you're in the US, financing activities only.

If you're outside the US, I would also check with your local accounting authority if they have any preference or follow any particular option (teacher, lecturer, textbook or accounting standards board).

Sorry if you were looking for a totally definitive answer, this one is not so cut-and-dry.

Good luck in your studies!

Best,

Michael Celender

Founder of Accounting Basics for Students

Related Questions & Tutorials:

- The Indirect Cash Flow Statement Method

- Cash Flow Statement: Current Year Profit & Retained Earnings

- Cash Flow Statement and Depreciation

- Bad debts in Cash Flow Statement?

- Cash Flow Statement Exercise (full solution)

Click here to return to the main Cash Flow Statement Tutorial

Comments for Cash Flow Statement:

|

||

|

||

|

||

|

||

|

||

|

||

© Copyright 2009-2021 Michael Celender. All Rights Reserved.

Click here for Privacy Policy.